Managing one’s personal finances can be daunting, but it’s getting easier and easier with technology. Apps, online tools, and automated systems mean you can easily stay on top of your budget and keep track of your savings in a matter of taps on your phone.

Many individuals are even set at a loss in trying to create their financial goals or even just more basic tracking of expenses. But where modern technology has reduced the gap by providing simple, easily understandable solutions that cut across age barriers and financial ignorance.

Whether you’re a young dreamer eager to save for a major goal, pay off debts, or invest in a better future, technology can help you achieve these ambitions more efficiently.

How To Answer A Debt Claim Citation

Facing a debt claim citation can be intimidating, but knowing how to respond is crucial to protecting your rights and avoiding default judgments. Technology has simplified the process, offering tools and resources to guide individuals through each step, from drafting responses to negotiating settlements. With apps and online platforms providing legal support and advice, even those unfamiliar with legal proceedings can confidently handle such situations.

Here’s everything you need to know about how to answer a debt claim citation, particularly in states like Texas, where timely responses are essential.

Facing a debt claim citation in Texas? You’re not alone – it’s crucial to know how to answer a debt claim citation in Texas since the state sees over 90,000 debt-related lawsuits annually. Many defendants don’t realize that failing to respond automatically results in a default judgment against them. With thousands of cases filed each year, Texas leads the nation in debt collection lawsuits, yet many residents are unaware of their rights and responsibilities when served with a citation.

Therefore, tech tools can play a huge role in this regard. Legal apps and other online resources can give step-by-step instructions in handling such complaints, from response to identifying one’s legal rights.

Budgeting and Saving Do Not Have to be Confused.

Budgeting once meant sitting down with a pen, paper, and calculator to figure out where your money was going. Now, budgeting apps make it much easier and more accurate. Many apps are available to track spending in real-time and even categorize expenses automatically.

These tools, by linking with your bank account, can give you exactly how much you are spending on groceries, rent, or even entertainment. Also, if you are approaching the budgeting limit for any category, you receive alerts about this, as well as about approaching bills. For people who are unable to follow financial plans, these applications make a big difference.

Savings apps are no less transformative. This kind of app helps you save money without even thinking about it. Acorns round up your purchases to the nearest dollar and invest the spare change, while Digit analyzes your spending habits and automatically sets aside small amounts of money for savings. With such tools, even those who think they “can’t save” find themselves building a financial cushion effortlessly.

Credit Management and Debt Relief

Many people find managing their credit scores and clearing off debts to be too much of a hassle. Recently, technology has made credit score tracking easier and more accessible by offering free tools. Applications develop tailored payment plans that suit your needs, and it helps prioritize which debt to pay first depending on the interest rates.

The application also gives reminders so that you do not miss a single payment, which means saving on costly late fees. To such people dealing with numerous loans or balances on credit cards, such resources are invaluable since they make complex things much more accessible.

Investing Made Available

Investing sounds like one of those tasks only financial professionals would do; however, this has been made very accessible by advancements in technology. Choose platforms give easy-to-understand guides and tutorials, so even beginners can make informed decisions. Robo-advisors are automated investment tools that have the ability to read out your financial goals and risk tolerance and provide a specialized investment strategy for you. As such, most of the guesswork is removed, and the act of investing is less intimidating.

Cryptocurrency has found a way into the personal management of finances too. Although using Coinbase and Binance to buy, sell, and move digital currency into an account is relatively simple, the high risks of using cryptocurrencies as money are reduced.

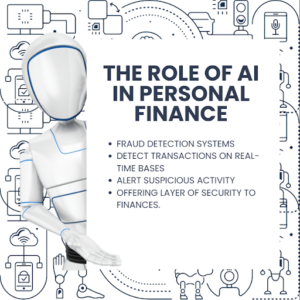

The Role of AI in Personal Finance

Artificial intelligence is now becoming a significant player in simplifying personal finance management. AI-powered virtual financial assistants who offer advice depending on your spending behaviors.

They can answer questions such as “Can I afford to eat out this weekend?” or “How much can I save if I skip my daily coffee run?” They give insights to you by analyzing your financial data to help you make better decisions.

AI also manages most of the fraud detection systems in banks and credit card companies. These detect your transactions on a real-time basis and alert you to suspicious activity, thereby offering a layer of security to your finances. Given all these conveniences and safety features, AI has become an inevitable tool in managing personal finance under modern management.

Insurance and Financial Planning Tools

Insurance and long-term financial planning will always look pretty complicated, but technology makes these areas no more complex either. Some apps make comparison of insurance policies easy. It further guides you step by step to ensure what you are signing up for makes sense.

Financial planning tools such as Personal Capital give the user a comprehensive view of their finances. All your accounts are linked, allowing for calculations of net worth, analysis of spending, and retirement planning. That is how this holistic approach makes it easy to set and achieve long-term financial goals.

Building Financial Literacy Through Technology

The most influential form of how technology changes personal finance has been the improvement in financial literacy. Websites, applications, and online courses provide free or low-cost lessons on budgeting to investing.

Platforms that have courses prepared to teach people financial basics in an entertaining fashion. The social media platform has also emerged as a gigantic hub for the teaching of finances, with various influencers and experts pushing tips through short videos and posts.

Another trend in financial literacy is gamification. Apps such as Habitica and S’more challenge users to reach financial goals by turning tasks into games. For example, you may earn points for saving a certain amount of money each month, which can be exchanged for rewards within the app. These tools make financial education fun, helping users build healthy habits without feeling overwhelmed.

Conclusion

Indeed, the future of personal finance technology seems bright. Blockchain, an innovation, promises even greater transparency and security to financial transactions. Meanwhile, improvements in machine learning will make financial tools even smarter and more personalized.

Imagine having an app that tracks your spending but also predicts future expenses and adjusts your budget automatically. These are the developments that will continue making it easier for everyone to manage their finances.

As technology advances, it will also become more inclusive. Many of the tools currently in use require access to smartphones or the internet, but future innovations may address this digital divide, ensuring that everyone can benefit from these advancements regardless of their economic background.

FAQs

- What is the best way to track my expenses?

Apps that categorize spending by linking to your bank account are excellent for tracking expenses.

- How do I start investing with little money?

Beginners can invest with as little as $5 through apps such as Robinhood or Stash which offer easy and beginner-friendly options.

- What should I do if I get a debt claim citation?

If you receive a debt claim citation, respond immediately using legal apps or consult an attorney to avoid defaulting on the case.