In the accounting industry, efficiency and professionalism are key to winning new clients and maintaining strong business relationships. Proposal software for accountants helps streamline the process of creating, sending, and managing client proposals with minimal effort. Instead of spending hours drafting proposals manually, accountants can leverage automation tools that generate customized, accurate, and professional proposals within minutes. These solutions eliminate errors, standardize pricing structures, and integrate seamlessly with other accounting tools, ensuring a smooth workflow from proposal creation to contract approval.

Beyond automation, proposal software plays a crucial role in enhancing client communication and transparency. With built-in e-signature features, real-time tracking, and automatic follow-ups, accountants can secure approvals faster, reducing the time spent on back-and-forth negotiations. Additionally, many platforms offer integration with billing, invoicing, and CRM software, allowing accountants to manage the entire client engagement process in one place. This not only improves efficiency but also ensures compliance with financial regulations, making proposal software an essential tool for modern accounting firms.

How Proposal Software for Accountants Saves Time & Reduces Errors

Choosing the right proposal software for an accounting firm requires careful evaluation of its features and capabilities. One of the most critical aspects is customization, as every client has unique financial needs and service requirements. A good proposal tool should allow accountants to tailor proposals by adding detailed service descriptions, fee structures, and legal disclaimers. Additionally, automated calculations ensure that pricing and taxes are applied correctly, reducing errors and miscommunication.

Another crucial feature is electronic signature integration, which accelerates the approval process and eliminates the need for physical paperwork. Many solutions also offer real-time tracking, allowing accountants to monitor when a proposal is viewed, commented on, or signed. This visibility helps firms follow up with clients proactively and close deals faster. Security and compliance are also major concerns, as accounting firms deal with sensitive financial data. Proposal software should include data encryption, secure cloud storage, and compliance with financial regulations such as GDPR and SOC 2. Lastly, seamless integration with CRM, accounting, and tax software ensures a streamlined workflow from proposal creation to client onboarding.

Top Proposal Software Solutions for Accounting Firms

For accounting firms, the ability to create well-structured and professional proposals is crucial for securing new clients and maintaining strong business relationships. A well-prepared proposal not only outlines services and pricing but also sets clear expectations, reducing potential misunderstandings. However, managing proposals manually can be time-consuming and inefficient. This is where Ignition, GoProposal, and PandaDoc provide valuable solutions, helping firms streamline proposal creation, automate approvals, and improve client engagement. These tools simplify the proposal process while ensuring consistency, professionalism, and compliance.

1. Ignition

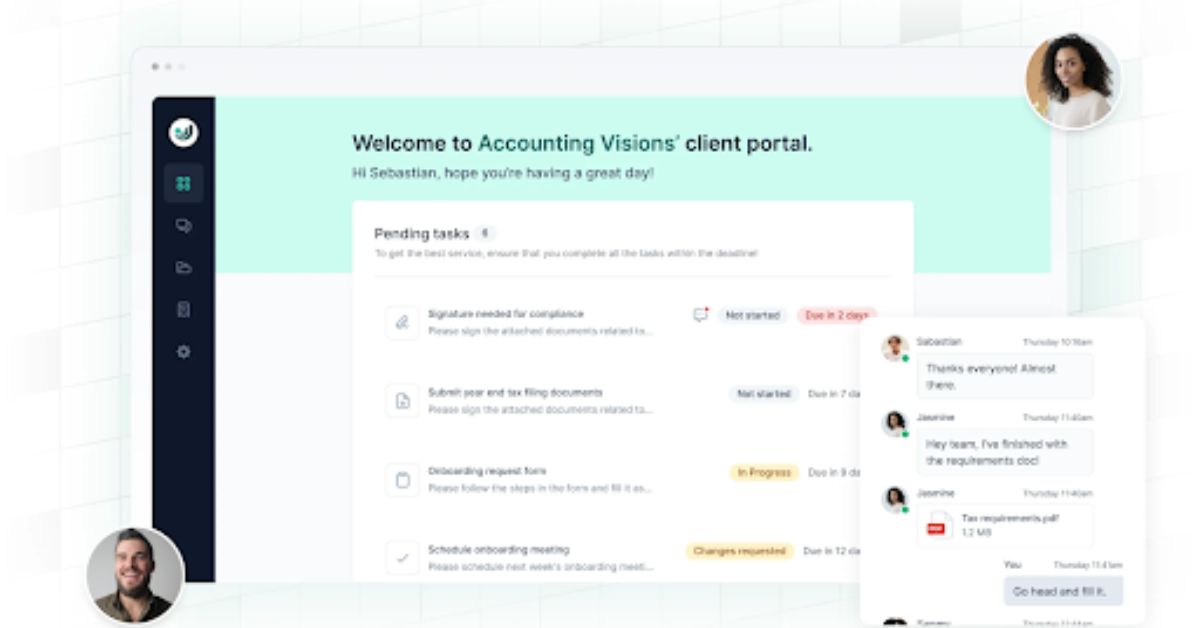

Ignition is a comprehensive proposal, engagement, and payment automation platform designed specifically for accounting firms. One of its standout features is its ability to automate billing, ensuring that once a proposal is accepted, payments are processed without manual follow-ups. With customizable proposal templates, accountants can quickly generate client-ready documents tailored to their services. Ignition’s electronic signature capability speeds up client approvals, reducing delays in onboarding. Additionally, its seamless integration with accounting software and CRM systems allows firms to streamline their workflow, minimize errors, and improve overall efficiency. By automating client agreements and payment collection, Ignition helps accountants focus on delivering high-value financial services rather than getting bogged down by administrative tasks.

2. GoProposal

GoProposal is a structured pricing and proposal management tool that helps accountants create transparent and scalable pricing models. One of its key features is the real-time pricing calculator, which ensures that every proposal includes accurate and consistent pricing based on the firm’s predefined rates. This eliminates uncertainty in pricing and fosters trust with clients. GoProposal also offers a range of customizable proposal templates, enabling firms to maintain a professional and branded appearance. Additionally, the platform’s automated engagement letter generation ensures that proposals are legally compliant, reducing risks associated with scope creep. With integration into accounting software and CRM platforms, GoProposal provides a seamless experience, allowing firms to manage client engagements more efficiently.

3. PandaDoc

PandaDoc is a document automation platform that simplifies proposal creation and management for accounting firms. With an extensive library of customizable templates, firms can generate professional and engaging proposals quickly. One of its most valuable features is its electronic signature tool, which allows clients to approve proposals instantly, expediting the onboarding process. PandaDoc also provides real-time document tracking, enabling firms to see when clients view, interact with, or take action on proposals. This feature helps firms follow up strategically, improving conversion rates. Additionally, PandaDoc integrates with accounting software, CRM systems, and payment processors, offering an all-in-one solution for automating the proposal workflow. By reducing manual effort and enhancing efficiency, PandaDoc helps firms maintain professionalism while focusing on delivering top-tier accounting services.

How Proposal Software Benefits Accounting Firms

Implementing proposal software offers numerous benefits beyond just saving time. One of the most significant advantages is improved client conversion rates. Professionally designed, well-structured proposals create a positive impression, increasing the likelihood of securing new clients. Additionally, automated workflows reduce administrative burdens, allowing accountants to focus on delivering high-value services rather than manual paperwork. By integrating proposals with invoicing and payment processing, firms can also enhance their financial operations and ensure timely payments.

Another major benefit is better compliance and accuracy. Proposal software ensures that engagement letters, service agreements, and fee structures align with regulatory requirements. Data security features, such as encryption and access controls, help protect sensitive financial information. Lastly, firms that use proposal software gain better insights into client interactions, allowing them to optimize their sales strategies and improve client relationships.

Final Thoughts

For modern accounting firms, proposal software is an essential tool for growth and efficiency. With options like Karbon, TaxDome, and Jetpack Workflow, firms can automate client proposals, eliminate manual errors, and close deals faster. The right solution depends on a firm’s specific needs—whether it’s customization, integration with accounting software, or advanced automation features.

By leveraging proposal software, accountants can improve client engagement, streamline workflows, and ultimately scale their business with greater ease. Investing in the right technology not only saves time but also enhances the firm’s professionalism, credibility, and overall profitability.