Trading can be an exhilarating journey, but it comes with its own set of challenges. One of the most critical aspects traders face is managing drawdowns—especially in platforms like MT5. If you’re navigating this terrain, understanding trailing drawdown could be your secret weapon. It’s not just about making profits; it’s also about protecting what you earn and ensuring that losses don’t spiral out of control.

In a world where market movements can change in an instant, knowing how to maximize your MT5 trailing max drawdown can make all the difference between long-term success and costly mistakes. Let’s dive deeper into what trailing drawdown really means and explore strategies to help you manage your trades more effectively while safeguarding your investments.

TRENDING

Padova Chicken: Savory Italian Flavors in Every Bite

Understanding Trailing Drawdown

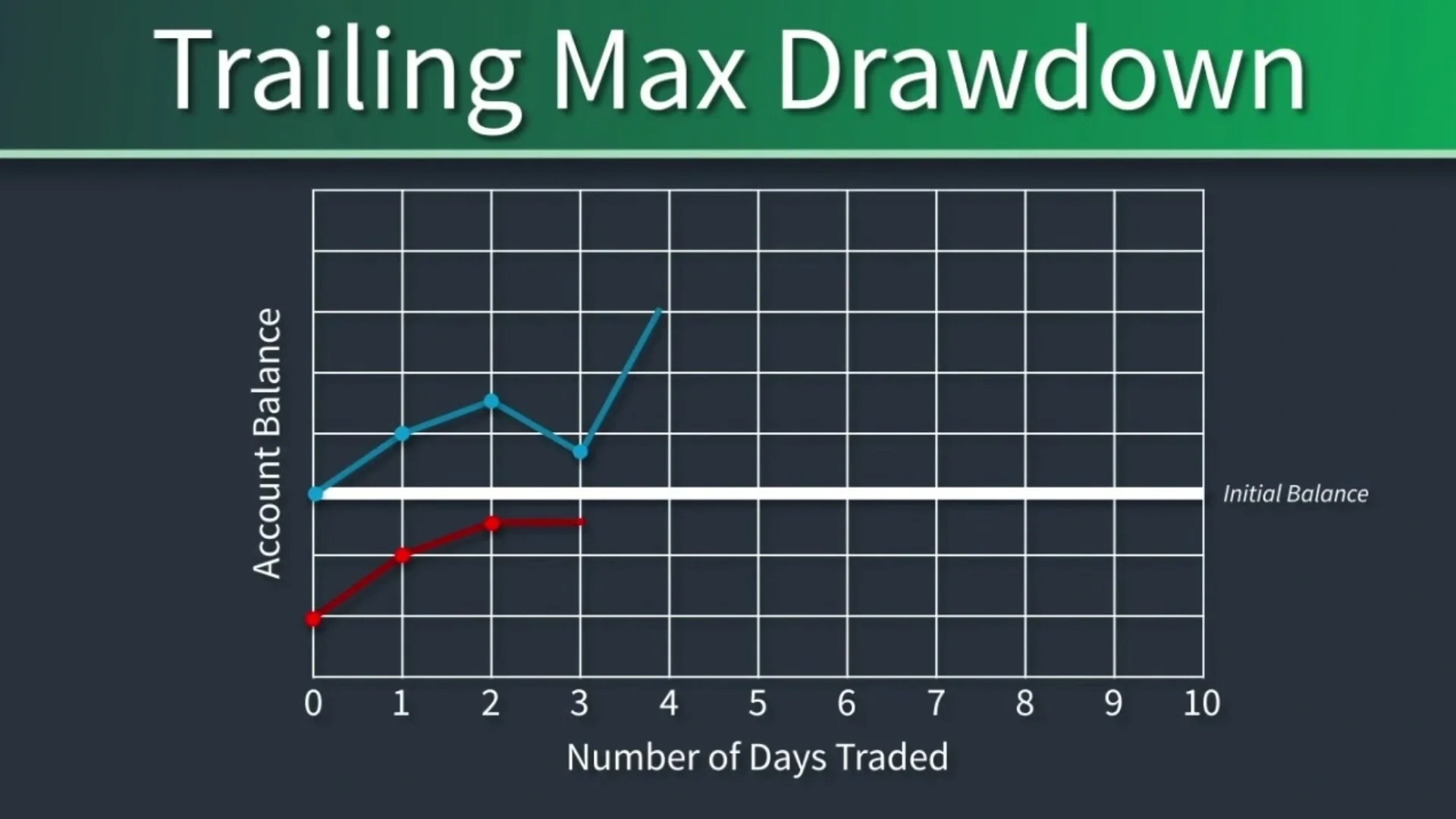

Trailing drawdown is a dynamic risk management tool designed to protect your capital while allowing for potential gains. Unlike fixed drawdown limits, it adjusts based on your account’s highest equity point. This means as your profits increase, so does the threshold for acceptable losses.

Imagine you have an initial balance of $10,000. If your account peaks at $12,000 and you’ve set a trailing max drawdown of 10%, then you can afford to lose up to $1,200 without being stopped out.

This approach helps maximize profit potential while minimizing risks during market fluctuations. Traders can stay in profitable positions longer without fear of losing everything if the market turns against them suddenly.

Understanding this concept allows traders to adapt their strategies effectively and make informed decisions that align with their trading goals and risk tolerance levels.

Importance Of Managing Trailing Drawdown in MT5

Managing trailing drawdown in MT5 is crucial for long-term trading success. A well-implemented strategy can protect your capital and enhance profitability.

When trading, fluctuations are inevitable. Drawdowns represent periods where your account value dips from its peak. Monitoring these changes helps maintain a healthy balance between risk and reward.

By managing trailing drawdown effectively, traders gain insights into their performance trends. This awareness allows for adjustments to strategies when necessary, preventing emotional decision-making during volatile market conditions.

Moreover, keeping an eye on drawdowns aids in developing realistic expectations about potential losses. Understanding this aspect encourages disciplined trading habits and adherence to risk management protocols.

In the competitive landscape of forex and CFD markets, being proactive with trailing drawdown not only safeguards investments but also fosters confidence in executing trades effectively.

Tips For Maximizing MT5 Trailing Drawdown

Maximizing MT5 trailing drawdown involves a blend of strategy and discipline. Start by analyzing your trading patterns to identify strengths and weaknesses. This self-awareness can guide you in adjusting your approach.

Another important tip is to implement gradual adjustments to your stop-loss settings. A slow, strategic increase allows for capturing more profit while protecting against sudden market shifts.

Utilize the built-in features of Meta Trader 5 effectively. Take advantage of automated scripts that help manage trades according to your defined parameters, reducing emotional decision-making during volatile times.

Monitoring market conditions continuously is essential too. Stay informed about news events or economic indicators that may impact price movements significantly, allowing timely adjustments to your strategies when necessary.

Remember, patience plays a crucial role in trading success as it helps maintain focus on long-term goals without succumbing to momentary fluctuations.

Utilizing Stop Loss Orders And Take Profit Levels

Stop loss orders are essential tools in managing risk. They automatically close a trade when it reaches a predetermined price, protecting your capital from significant losses. By setting an appropriate stop loss level, you can safeguard against unexpected market movements.

Take profit levels play a similar role but on the opposite end of the spectrum. These orders secure your profits by closing trades once they hit specific targets. It’s crucial to set these levels based on realistic expectations and market analysis.

When using MT5, take advantage of its features to customize these orders effectively. This way, you can focus on executing your strategy rather than reacting impulsively to market fluctuations.

Diversifying Your Trading Portfolio

Diversification is a key strategy in trading to minimize risk and enhance potential returns. Rather than putting all your capital into one asset, consider spreading your investments across various markets or instruments.

By doing this, you reduce the impact of a poor-performing trade on your overall portfolio. If one asset suffers losses, gains in another can help offset those downturns. This balance creates a more stable trading environment.

Explore different asset classes like stocks, currencies, commodities, or indices. Each reacts differently to market conditions, offering unique opportunities for profit.

Regularly review and adjust your portfolio as market dynamics shift. Staying informed about trends will help you make timely decisions that align with your diversification goals.

Remember: it’s not just about having multiple trades open but ensuring they complement each other effectively within the broader context of mt5 trailing max drawdown management strategies.

Setting Realistic Expectations And Risk Management Strategies

Setting realistic expectations is crucial in trading. Many newcomers enter the market with dreams of quick wealth, only to face harsh realities. It’s essential to have a grounded perspective on potential profits and losses.

Understanding that losses are part of the process can help traders maintain composure during downturns. Emphasizing risk management strategies protects your capital over time.

One effective approach is determining how much you’re willing to lose on each trade. This helps limit your exposure and prevents emotional decision-making when facing setbacks.

Additionally, consider using tools like stop-loss orders and position sizing techniques. These methods safeguard against substantial losses while allowing room for growth.

By focusing on achievable goals rather than unrealistic fantasies, you create a sustainable trading mindset. This balanced view fosters resilience—an invaluable trait in navigating the ups and downs of financial markets.

Conclusion

Maximizing MT5 trailing drawdown is essential for traders looking to protect their investments while capitalizing on market opportunities. By understanding what trailing drawdown means and its impact on your trading strategy, you set a solid foundation for success.

Effective management of trailing drawdown can significantly enhance your trading performance in MT5. With the right approach, including utilizing stop loss orders and take profit levels, diversifying your portfolio, and setting realistic expectations coupled with sound risk management strategies, you can navigate the complexities of the forex market more effectively.

By implementing these tips, you’ll not only safeguard your capital but also position yourself to thrive in various market conditions. Remember that each trader’s journey is unique; adjust these practices to fit your personal trading style. Embrace the tools available within MT5 and watch as you make strides toward maximizing your potential gains while minimizing risks associated with drawdowns.

ALSO READ: Exploring Pornichet: Coastal Charms And Tranquil Escapes

FAQs

What is MT5 Trailing Max Drawdown?

Trailing max drawdown in MT5 is a dynamic risk management tool that adjusts your drawdown limit based on your account’s highest equity point. It protects your gains by allowing the drawdown threshold to rise with your account’s profits, helping you safeguard your capital while optimizing profit potential.

How Does Trailing Max Drawdown Differ from Fixed Drawdown Limits?

Unlike fixed drawdown limits, which remain constant regardless of account performance, trailing max drawdown adjusts automatically as your equity increases. This flexibility helps in protecting gains and reducing risk during market fluctuations, offering a more adaptive approach to risk management.

What Are the Benefits of Using Trailing Max Drawdown in Trading?

The primary benefits include enhanced capital protection, extended trade longevity, and improved profit potential. By adjusting the drawdown limit based on the highest equity point, traders can stay in profitable positions longer and avoid premature stop-outs due to market reversals.

How Can I Effectively Manage Trailing Max Drawdown in MT5?

To manage trailing max drawdown effectively, analyze your trading patterns, adjust stop-loss settings gradually, utilize MT5’s automated features, and stay informed about market conditions. These practices help in maintaining a balanced risk-reward ratio and adapting to market changes.

What Role Do Stop Loss Orders and Take Profit Levels Play in Managing Drawdown?

Stop loss orders and take profit levels are crucial for managing risk and securing profits. Stop losses protect against significant losses by closing trades at a predetermined price, while take profit levels lock in gains once specific targets are reached. Both tools work together to maintain discipline and reduce emotional decision-making.